In many cases, losing a husband also means losing a financial partner. Suddenly, a widow is faced with essential decisions that she must consider single-handedly...

Read More

We’re Fiduciaries!

Fiduciaries are bound by law to put their client’s interest first. We take our roles as trusted advisors seriously. We will be there to guide you through life’s tough decisions without you believing for a second that your success follows ours.

We earn our clients trust and confidence in our approach to personal finance by tailoring our strategic recommendations to their personal situation. Our goal is to help you plan for life events you expect and overcome those you don’t.

Why Latko Wealth Management?

There are more than 130,000 financial advisors in the united states, why should you work with Latko Wealth Management, Ltd.? We have the heart of a teacher and we want you to understand and be educated on your investments – with as much or as little information as you’d like.

We make the complex simple. As your trusted advisor, we're focused on adding convenience and simplicity to your life. We are much more than results. We’re about helping you understand where those results came from and why we chose the strategy we did. If you are tired of the mystery of investing and want to know exactly what’s happening with your money, schedule an appointment today.

OUR MISSION

To help our clients manage their wealth through the transitions of life through education, communication and service which exceeds their expectations.

OUR VISION

We want to be known as the most caring, collaborative, and client-focused wealth management firm by building lifelong relationships with every client and those they care most about.

LOW FEES/TRANSPARENCY

Most of our clients pay between .50-1.50% of assets under management for investment expertise depending on the size and complexity of the account. Your costs will be clearly defined and easy to understand with expenses kept low by using low cost Exchange Traded Funds (ETFs) and mutual funds. We do not charge our clients for office appointments or phone calls.

Financial Planning

Investment Management

Trust/Estate Planning

Risk Management

Tax Strategies

Charitable Giving

Retirement

Social Security Guidance

College Preparation

Meet the Family

We want you to feel like part of our family.

We at Latko Wealth Management, Ltd. strongly believe in investing in our community, and we know that the younger generations are our greatest asset. That is why we are thrilled to sponsor the industry’s leading personal finance curriculum, Foundations in Personal Finance. We’re providing it free of charge to the Lincoln Way area high schools starting in the Fall of 2021.

We at Latko Wealth Management, Ltd. strongly believe in investing in our community, and we know that the younger generations are our greatest asset. That is why we are thrilled to sponsor the industry’s leading personal finance curriculum, Foundations in Personal Finance. We’re providing it free of charge to the Lincoln Way area high schools starting in the Fall of 2021.

We have joined forces with Dave Ramsey, one of America’s most well-known financial experts. This relationship reflects Latko Wealth Management’s desire to help clients manage their wealth through the transitions of life and serve as a leader in our communities.

Jim King, Vice President of Ramsey Education Solutions, said, “we are thrilled to be working with Latko Wealth Management, Ltd. They have demonstrated a strong commitment to financial education and empowering students with financial skills that will last a lifetime.”

Dave Ramsey’s Foundations in Personal Finance course is a comprehensive curriculum designed to provide students with sound financial principles that will guide them into adulthood. On video, Ramsey and his team educate and entertain students as they learn how to avoid debt, build wealth, and give like no one else.

Look for exciting updates! We’ll be sharing more about the schools we’re sponsoring and the number of students receiving the money skills that will help them thrive in today’s economy.

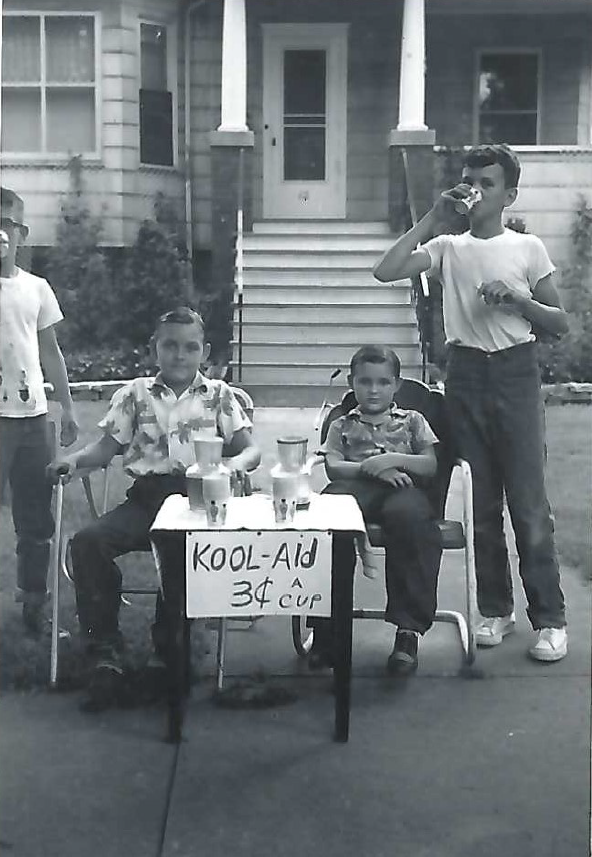

John and David Latko at the

Kool-aid stand in 1958

Latko Wealth Management, Ltd. was built from the hard work, high morals, and deep compassion of our President, David Latko. While moving up ranks and working at top “brand-name” financial firms, David found himself discouraged by the “sales over service” mentality he saw around him. David knew his clients deserved more than the “product of the month” and wanted his clients to understand where their money was going and what they were paying. On his own he could model this new company around the client with regular communication, education, and genuine care.

Wanting to start a family of their own yet staying near to their families David, and wife Janice, decided to plant roots in Frankfort, IL and later moved to nearby Mokena, IL. They are both highly involved at their church and are often found helping and laughing around the community. David added his brother, John Latko, to his staff as this was their second business venture together. The first being a highly sought-after Kool-Aid stand in Hammond, IN during the summer of 1958. David and Janice now have 2 children, Tiffany and David Jr. who both graduated from Olivet Nazarene University and are both crucial pieces in the company along with their family dog, Sunoco. Tiffany’s love for people and bubbly personality make her an amazing Director of First Impressions. David Jr. perfectly fulfills his role as an advisor sharing his father’s desire to educate and empower clients on their investments. Both possess the same high morals and deep compassion for the community and people around them, as their parents.

Left to right: Jan Latko, David Latko Jr.,

Marissa Latko, David Latko Sr., Tiffany Latko

What We Do

Dynamic Planning

With State-of-the-art software, we run a series of scenario analyses to provide a dynamic, continuously updated view of your financial situation today, and in the future. The goal is simple: to help successful individuals simplify their personal finances and plan for the future with confidence.

FAMILY

The people you love are your strongest motivation—in all areas of life, including financial planning. Latko Wealth Management, Ltd. helps develop strategies so you and your family can live the best life possible, given the money you have.

RETIREMENT

“Are you saving enough for retirement?” isn’t the right question. Savings are not as sustainable as a personal investment strategy. We develop one for you that will take over as a main revenue stream when your salary is no more.

LEGACY

What you do today has a huge effect on what tomorrow can be. Position yourself now to make the most of your estate. You realize the financial planning process extends beyond you, to other generations and even causes that you care about. We help ensure your assets will be distributed according to your wishes in the most tax-advantageous way, to maximize the support for your family and charitable organizations.

Latko Wealth Management Brochure

The Latko Wealth Management Difference. 8 ways to benefit and more...Download PDF

Inspiration

Resources

Welcome to our research center! We have created a library of information on important financial topics that we believe you'll find helpful.CALCULATORS

A host of financial tools to assist you.

ARTICLES

Educate yourself on a variety of financial topics.

FLIPBOOKS

These magazine-style flipbooks provide helpful information on a variety of financial topics and illustrate key financial concepts.

VIDEOS

These engaging, short animations focus on a variety of financial topics and illustrate key financial concepts.

GLOSSARY

Financial terms from A to Z.

NEWSLETTERS

Timely newsletters to help you stay current.

Come See Us, By Appointment Only.

45 E. Colorado Ave.

Frankfort, IL 60423