In many cases, losing a husband also means losing a financial partner. Suddenly, a widow is faced with essential decisions that she must consider single-handedly...

Read More

We’re Fiduciaries!

Fiduciaries are bound by law to put their client’s interest first. We take our roles as trusted advisors seriously. We will be there to guide you through life’s tough decisions without you believing for a second that your success follows ours.

We earn our clients trust and confidence in our approach to personal finance by tailoring our strategic recommendations to their personal situation. Our goal is to help you plan for life events you expect and overcome those you don’t.

Why Latko Wealth Management?

There are more than 130,000 financial advisors in the united states, why should you work with Latko Wealth Management, Ltd.? We have the heart of a teacher and we want you to understand and be educated on your investments – with as much or as little information as you’d like.

We make the complex simple. As your trusted advisor, we're focused on adding convenience and simplicity to your life. We are much more than results. We’re about helping you understand where those results came from and why we chose the strategy we did. If you are tired of the mystery of investing and want to know exactly what’s happening with your money, schedule an appointment today.

OUR MISSION

To help our clients manage their wealth through the transitions of life through education, communication and service which exceeds their expectations.

OUR VISION

We want to be known as the most caring, collaborative, and client-focused wealth management firm by building lifelong relationships with every client and those they care most about.

LOW FEES/TRANSPARENCY

Most of our clients pay between .80-1.35% of assets under management for investment expertise depending on the size and complexity of the account. Your costs will be clearly defined and easy to understand with expenses kept low by using low cost Exchange Traded Funds (ETFs) and mutual funds. We do not charge our clients for office appointments or phone calls.

Dave Ramsey SmartVestor Pro

SmartVestor Pros are held to a higher standard of excellence. To become a SmartVestor Pro there is a 45-person team that interviews the applicant several times to make sure the advisor provides the advice Dave Ramsey would give. They also make sure that it is someone you feel comfortable talking to and is a person you can trust.

Financial Planning

Investment Management

Trust/Estate Planning

Risk Management

Tax Strategies

Charitable Giving

Retirement

Social Security Guidance

College Preparation

Dave Ramsey

Being a SmarVestor Pro isn’t easy; it’s hard work because they’re held to a higher standard of excellence. There is a 45-person team that interviews potential Smartvestor Pros several times and provide support to make sure your Smartvestor Pro provides the advice Ramsey Solutions would give. They also make sure that every Smartvestor Pro is someone you can feel comfortable talking to and is a person you can trust. On top of that, every Smartvestor Pro is evaluated every month, to make sure the best agent possible is recommended. Every person who uses a Smartvestor Pro has the chance to grade them based on their personal experience through surveys provided.

What does it mean to be a SmartVestor Pro?

I agree to the SmartVestor Code of Conduct.

I believe everyone deserves access to solid, professional investing guidance. I have earned my position as a SmartVestor Pro because of my experience in the industry and my drive to help others.

I provide a refreshing twist on financial planning.

I have the heart of a teacher, not the attitude of a salesman. I’m someone you can feel comfortable talking to and someone you can trust. We’ll work together to create a plan to help you reach your goals.

I care about your future.

I’m more than a “financial planner”—I’m someone you can relate to and share your dreams with. I fit your investments to your life, help you understand what you’re investing in and why, and encourage you to stick with your long-term goals.

SmartVestor is an advertising and referral service for investment professionals operated by The Lampo Group, LLC d/b/a Ramsey Solutions (RS). When you provide your contact information through the SmartVestor site, RS will introduce you to up to five (5) investment professionals (Pros) that are in your geographic area, including David W Latko ("Adviser"). It is up to you to interview Adviser and decide whether you want to hire them. If you decide to hire Adviser, you will enter into an agreement directly with Adviser to provide you with investment advisory services. Adviser has signed a Code of Conduct under which it has agreed to certain general investment principles, such as eliminating debt and investing for the longer-term, that are consistent with Dave Ramsey's philosophy, but RS does not monitor or control the investment advisory services Adviser provides.

Adviser has entered into an arrangement with RS under which Adviser pays RS flat monthly fees to advertise its services through SmartVestor and to receive client referrals in the form of an initial introduction to interested consumers who are located in Adviser's geographic region. The fees paid by Adviser to RS are paid irrespective of whether you become a client of Adviser, and are not passed along to you. However, the presence of these arrangements may affect Adviser’s willingness to negotiate below its standard investment advisory fees, and therefore may affect the overall fees you pay. Please ask your Adviser for more information about its fees.

RS is not affiliated with Adviser and neither RS nor any of its representatives are authorized to provide investment advice on behalf of Adviser or to act for or bind Adviser. No investment advisory agreement with Adviser will become effective until accepted by Adviser.

Neither RS nor its affiliates are engaged in providing investment advice. RS does not receive, control, access or monitor client funds, accounts, or portfolios. RS does not warrant any services of Adviser or any SmartVestor Pro and makes no claim or promise of any result or success by retaining Adviser. Your use of SmartVestor, including the decision to retain the services of Adviser, is at your sole discretion and risk. Any services rendered by Adviser are solely that of the Adviser. The contact links provided connect to third-party sites. RS and its affiliates are not responsible for the accuracy or reliability of any information contained on third-party websites.

Meet the Family

We want you to feel like part of our family.

We at Latko Wealth Management, Ltd. strongly believe in investing in our community, and we know that the younger generations are our greatest asset. That is why we are thrilled to sponsor the industry’s leading personal finance curriculum, Foundations in Personal Finance. We’re providing it free of charge to the Lincoln Way area high schools starting in the Fall of 2021.

We at Latko Wealth Management, Ltd. strongly believe in investing in our community, and we know that the younger generations are our greatest asset. That is why we are thrilled to sponsor the industry’s leading personal finance curriculum, Foundations in Personal Finance. We’re providing it free of charge to the Lincoln Way area high schools starting in the Fall of 2021.

We have joined forces with Dave Ramsey, one of America’s most well-known financial experts. This relationship reflects Latko Wealth Management’s desire to help clients manage their wealth through the transitions of life and serve as a leader in our communities.

Jim King, Vice President of Ramsey Education Solutions, said, “we are thrilled to be working with Latko Wealth Management, Ltd. They have demonstrated a strong commitment to financial education and empowering students with financial skills that will last a lifetime.”

Dave Ramsey’s Foundations in Personal Finance course is a comprehensive curriculum designed to provide students with sound financial principles that will guide them into adulthood. On video, Ramsey and his team educate and entertain students as they learn how to avoid debt, build wealth, and give like no one else.

Look for exciting updates! We’ll be sharing more about the schools we’re sponsoring and the number of students receiving the money skills that will help them thrive in today’s economy.

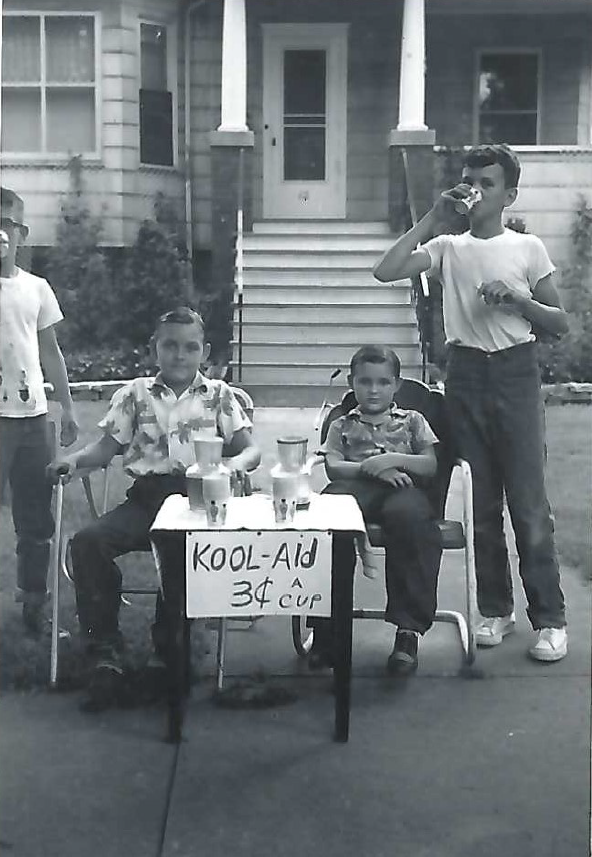

John and David Latko at the

Kool-aid stand in 1958

Latko Wealth Management, Ltd. was built from the hard work, high morals, and deep compassion of our President, David Latko. While moving up ranks and working at top “brand-name” financial firms, David found himself discouraged by the “sales over service” mentality he saw around him. David knew his clients deserved more than the “product of the month” and wanted his clients to understand where their money was going and what they were paying. On his own he could model this new company around the client with regular communication, education, and genuine care.

Wanting to start a family of their own yet staying near to their families David, and wife Janice, decided to plant roots in Frankfort, IL and later moved to nearby Mokena, IL. They are both highly involved at their church and are often found helping and laughing around the community. David added his brother, John Latko, to his staff as this was their second business venture together. The first being a highly sought-after Kool-Aid stand in Hammond, IN during the summer of 1958. David and Janice now have 2 children, Tiffany and David Jr. who both graduated from Olivet Nazarene University and are both crucial pieces in the company along with their family dog, Sunoco. Tiffany’s love for people and bubbly personality make her an amazing Director of First Impressions. David Jr. perfectly fulfills his role as an advisor sharing his father’s desire to educate and empower clients on their investments. Both possess the same high morals and deep compassion for the community and people around them, as their parents.

Left to right: Jan Latko, David Latko Jr.,

Marissa Latko, David Latko Sr., Tiffany Latko

What We Do

Dynamic Planning

With State-of-the-art software, we run a series of scenario analyses to provide a dynamic, continuously updated view of your financial situation today, and in the future. The goal is simple: to help successful individuals simplify their personal finances and plan for the future with confidence.

FAMILY

The people you love are your strongest motivation—in all areas of life, including financial planning. Latko Wealth Management, Ltd. helps develop strategies so you and your family can live the best life possible, given the money you have.

RETIREMENT

“Are you saving enough for retirement?” isn’t the right question. Savings are not as sustainable as a personal investment strategy. We develop one for you that will take over as a main revenue stream when your salary is no more.

LEGACY

What you do today has a huge effect on what tomorrow can be. Position yourself now to make the most of your estate. You realize the financial planning process extends beyond you, to other generations and even causes that you care about. We help ensure your assets will be distributed according to your wishes in the most tax-advantageous way, to maximize the support for your family and charitable organizations.

Latko Wealth Management Brochure

The Latko Wealth Management Difference. 8 ways to benefit and more...Download PDF

Latko Wealth Management Handout

Take a deeper dive and see what drives investment returns and more...Download PDF

Inspiration

Resources

Welcome to our research center! We have created a library of information on important financial topics that we believe you'll find helpful.CALCULATORS

A host of financial tools to assist you.

ARTICLES

Educate yourself on a variety of financial topics.

FLIPBOOKS

These magazine-style flipbooks provide helpful information on a variety of financial topics and illustrate key financial concepts.

VIDEOS

These engaging, short animations focus on a variety of financial topics and illustrate key financial concepts.

GLOSSARY

Financial terms from A to Z.

NEWSLETTERS

Timely newsletters to help you stay current.

Come See Us, By Appointment Only.

45 E. Colorado Ave.

Frankfort, IL 60423